In today's financial landscape, individuals with bad credit often face significant hurdles when seeking loans. Traditional lenders, including banks and credit unions, typically rely on credit scores to assess a borrower's creditworthiness. For someone with a poor credit history, this can result in denied applications and limited financial options. However, hard money personal loans present an alternative solution. This case study explores the dynamics of hard money loans for individuals with bad credit, the advantages and disadvantages, and real-life scenarios that illustrate their impact.

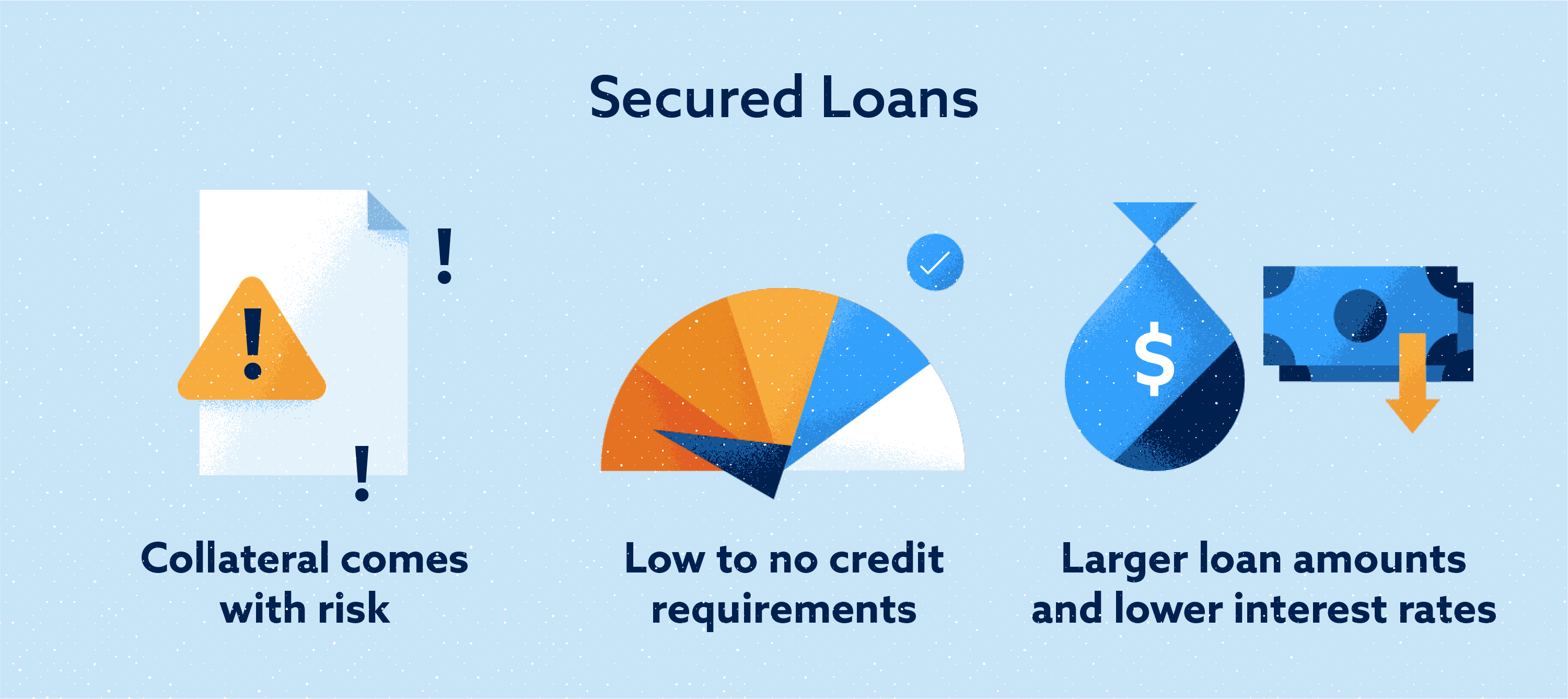

Hard money loans are short-term loans secured by real estate. Unlike traditional loans, which are evaluated based on the borrower's credit score, hard money loans focus primarily on the value of the collateral—typically real estate. This means that even individuals with bad credit can qualify for a loan if they have sufficient equity in a property. Hard money lenders are often private investors or companies that specialize in providing these types of loans.

While hard money loans offer a viable solution for individuals with bad credit, they are not without their drawbacks.

To better understand the implications of hard money personal loans for individuals with bad credit, let’s examine a few hypothetical scenarios.

Sarah, a 35-year-old single mother with a credit score of 580, faced unexpected medical expenses after her son was hospitalized. With limited savings and no access to traditional loans, Sarah turned to a hard money lender. She owned a home with significant equity, which allowed her to secure a hard money loan quickly. Within a week, she received the funds needed to cover her son’s medical bills. Although the interest rate was higher than she had anticipated, the quick access to cash allowed her to avoid further complications.

John, a real estate investor with a credit score of 620, wanted to purchase a distressed property to renovate and flip. Traditional lenders were hesitant to approve his loan due to his credit history, despite the property’s potential value. John approached a hard money lender who evaluated the property instead of his credit score. He secured a hard money loan that allowed him to purchase the property and complete renovations. After selling the property for a profit, John was able to pay off the loan, demonstrating how hard money loans can be leveraged for investment opportunities.

Lisa, a homeowner struggling with financial difficulties, faced foreclosure due to missed mortgage payments. With her credit score in the low 500s, she was ineligible for traditional refinancing options. A hard money lender offered her a loan based on her home’s equity, allowing her to pay off her existing mortgage and avoid foreclosure. While the loan came with high interest rates, Lisa was relieved to keep her home and had a plan to improve her credit and refinance in the future.

Hard money personal loans can be a lifeline for individuals with bad credit who find themselves in urgent need of funds or seeking investment opportunities. While these loans provide quick access to capital and are based primarily on collateral, borrowers must weigh the high costs and potential risks associated with them. It is essential for individuals to conduct thorough research, understand the terms of the loan, and have a clear repayment plan in place.

In summary, hard money loans can serve as a valuable financial tool for those with bad credit, provided that borrowers approach them with caution and a strategic mindset. By understanding the implications, advantages, and disadvantages of hard money loans, individuals can make informed decisions that align with their financial goals.

No Data Found!